Ssa retirement estimator

If railroad retirement benefits are received amounts from Box 5 on Form RRB-1099. Form 8962 Premium Tax Credit.

Social Security Retirement Calculator Online 57 Off Www Wtashows Com

Users can customize their estimates by changing their stop-work age and expected future earnings.

. Form 1095-A Health Insurance Marketplace Statement. You may also get a copy of Form W-7A at an IRS walk-in office or by calling 800-829-3676. Based on Society of Actuaries RP-2014 Mortality Table projected with Mortality Improvement Scale MP-2020 as of 2021.

Recipients born before 1946. For more information see Affordable Care Act ACA Tax Provisions. Mail at the following address.

Mail my paper form. Department of the Treasury Internal Revenue Service Center Ogden UT 84201-0024. Under FEDMER both OPM and SSA will receive the same medical records at the time of application.

Approved Software Vendors Form 8955-SSA Mandatory Electronic Filing for Certain Form 8955-SSA and 5500-series Returns. Apply For Retirement Benefits Our online retirement application lets you apply for retirement in as little as 15 minutes. Department of the Treasury Internal Revenue Service Center Ogden UT 84201-0024.

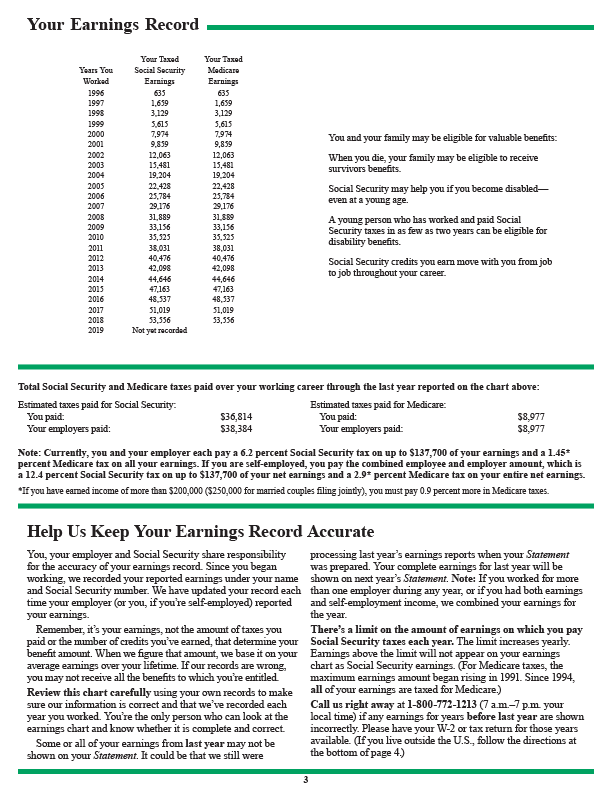

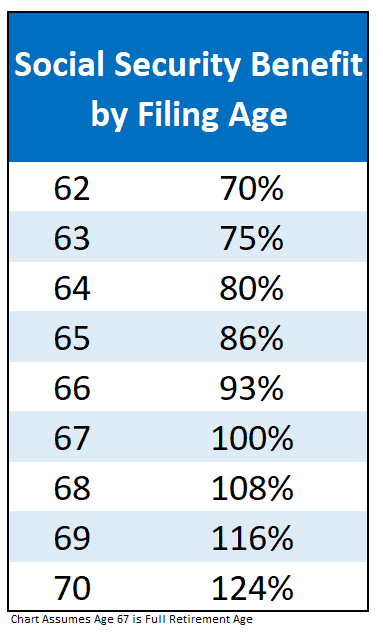

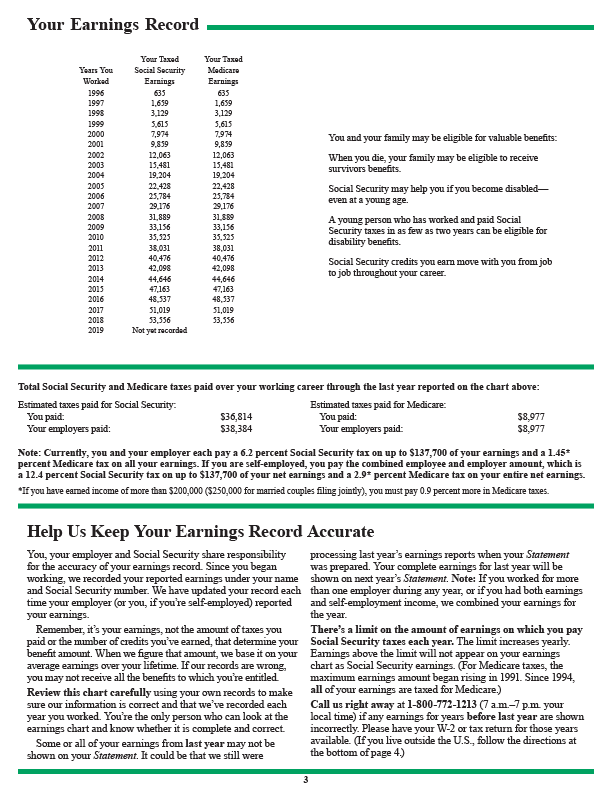

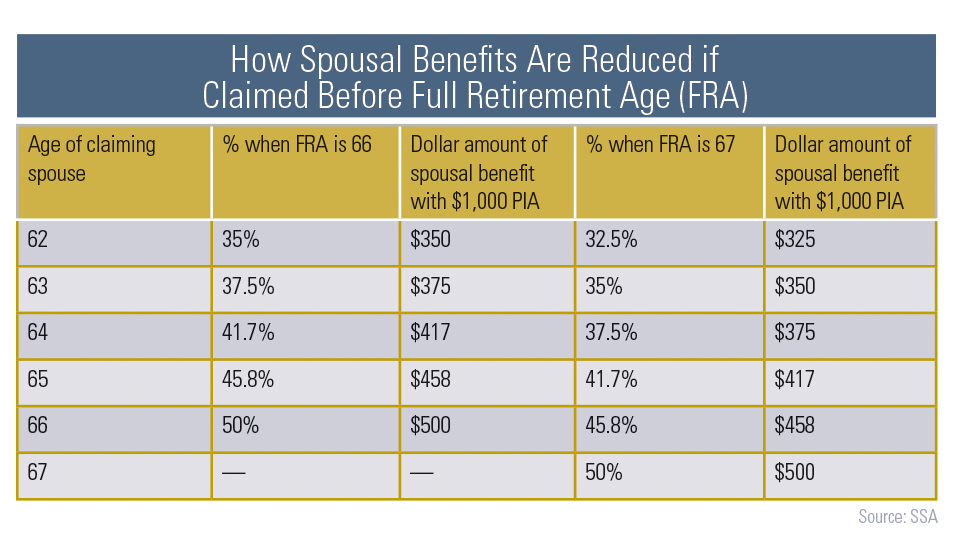

If you choose to start your benefits early they will be reduced based on the number of months you receive benefits before you reach your full retirement ageIf you wait until full retirement age your benefits will. Form 8955-SSA can also be submitted to the IRS on paper by US. Form 8955-SSA can be submitted by private delivery services to the following address.

Hiring for Assistant Accountant 07012022. Form 1099-SSA Social Security Benefits Statement. If social security benefits are received amounts from Box 5 on Form SSA-1099.

We hope this is helpful. Form 1099-MISC Miscellaneous Income. Use a separate Form 5558 for an extension of time to file Form 5330 or Form 5500 series.

Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Forms 1099-DIV and 1099-R showing dividends and distributions from retirement and other plans paid to you during the year. Signatures are needed for extension to file Form 5330 but not for extension to file Form 5500 series or Form 8955-SSA.

This ruling made it possible for same-sex couples to benefit from SSA programs. Federal Medical Evidence of Record FEDMER - Under the Federal Employees Retirement System FERS law entitlement to Social Security disability benefits affects an individuals eligibility to the OPM-administered disability program. To be eligible for Social Security Benefits you need to have worked and paid into the system for a minimum of 40 quarters or 10 years.

The ssatools third-party online calculator calculates your PIA based on 1 past Social Security earnings record as well as 2 estimated future estimated earnings and number of additional years of earnings. My Social Security Retirement Estimate Get personalized retirement benefit estimates based on your actual earnings history. My ssa had a big jump from 735 to 916 is that.

The Form W-7A Application for Taxpayer Identification Number for Pending Adoptions PDF is used by qualifying taxpayers to obtain an ATIN. We would like to show you a description here but the site wont allow us. It requires you to gather your earnings record from the ssagov site and then copy and paste that info into the tool.

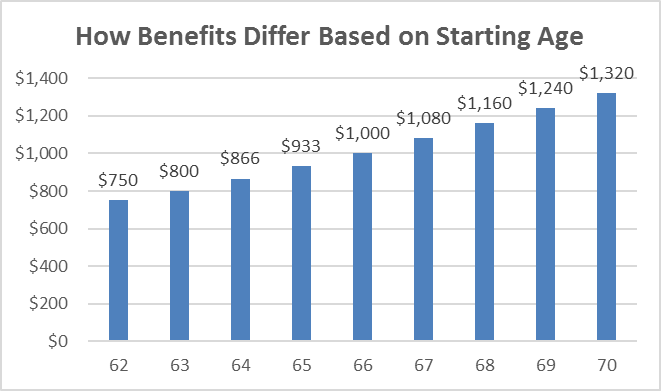

How to Calculate Your Social Security Income. Benefits When You Set Up a Retirement Plan. Your monthly benefit amount will be different depending on the age you start receiving it.

Private delivery services should send Form 8955-SSA to. SSAs Retirement Estimator not included in Table 2 uses actual earnings records to generate benefit estimates at age 62 FRA and age 70. May use a single Form 5558 to extend the Form 5500 and Form 8955-SSA filed for the same plan.

Board Adopts Interest Rate and Investment Rate of Return for June 30 2022. You can also view retirement benefit estimates by. You can use our online Retirement Estimator.

Tax Refund Estimator For 2021 Taxes in 2022. Choosing a Retirement Plan. Return To A Saved Application Already started an application.

Avoid errors when requesting an extension. To use the tool individuals must have enough Social Security credits to qualify for benefits. Internal Revenue Service Submission Processing Center 1973 Rulon White Blvd.

I now know that I meet the requirements to apply for an ATIN. Pick up where you left off. February 24 2021 603AM.

Use the SSAs Social Security Retirement Estimator to project how much of your retirement income will come from Social Security. For individualized estimates one could try the Retirement Estimator from the Social Security Administration. The SS Estimator shows if I stop work now 56 with no further SS taxcontributions Id only receive 50 less than if I continued to work at this higher rate for the next 6 years.

With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. 403b 457b Defined Benefit. Citizens or resident aliens for the entire tax year for which theyre inquiring.

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Form 1099-G Certain Government Payments.

For 2021 you may subtract all qualifying retirement and pension benefits received from public sources and may subtract private retirement and pension benefits up to 54404 if single or married filing separately or up to 108808 if married filing jointly. The tool is designed for taxpayers who were US. Form 1099-SSA Social Security Benefits Statement.

Your personal my Social Security account gives you secure access to information based on your earnings history and interactive tools tailored to you. What form do I use to apply for an ATIN. It assumes a person is in good.

For joint filers the age of the oldest spouse determines the age category. Form 1099-G Certain Government Payments. Check-Ups for Retirement Plans.

Send the completed Form 8955-SSA to. The longer you wait the higher the amount of the benefits.

How To Calculate Social Security Benefits 3 Easy Steps Youtube

When Can I Retire This Formula Will Help You Know Sofi

Social Security Statements

Savvy Social Security Planning

How Early Retirement Reduces Projected Social Security Benefits

Social Security Retirement 101 Barnum Financial Group

Retirement Calculator With Social Security Hot Sale 50 Off Www Wtashows Com

Timing Social Security A Very Personal Review Of Claiming Calculators Wealth Management

How Early Retirement Reduces Projected Social Security Benefits

Valuing Social Security As A Retirement Income Asset

Analysis Of Benefit Estimates Shown In The Social Security Statement

How Early Retirement Reduces Projected Social Security Benefits

The Average Social Security Benefit Is Not Enough For Retirement

Social Security Benefits Strategies For Divorcing Spouses

Social Security Retirement Income Calculator

How Much Would You Receive From Disability Benefits Washington Post

Social Security Calculators That Can Help You Decide When To Claim Vermont Maturity